Order processing, And Checkout

Seamless integration for your workflow, from payment to fulfillment.

Designed to fit perfectly with the platforms you rely on, from order systems to accounting and beyond.

Complete Payment Ecosystem

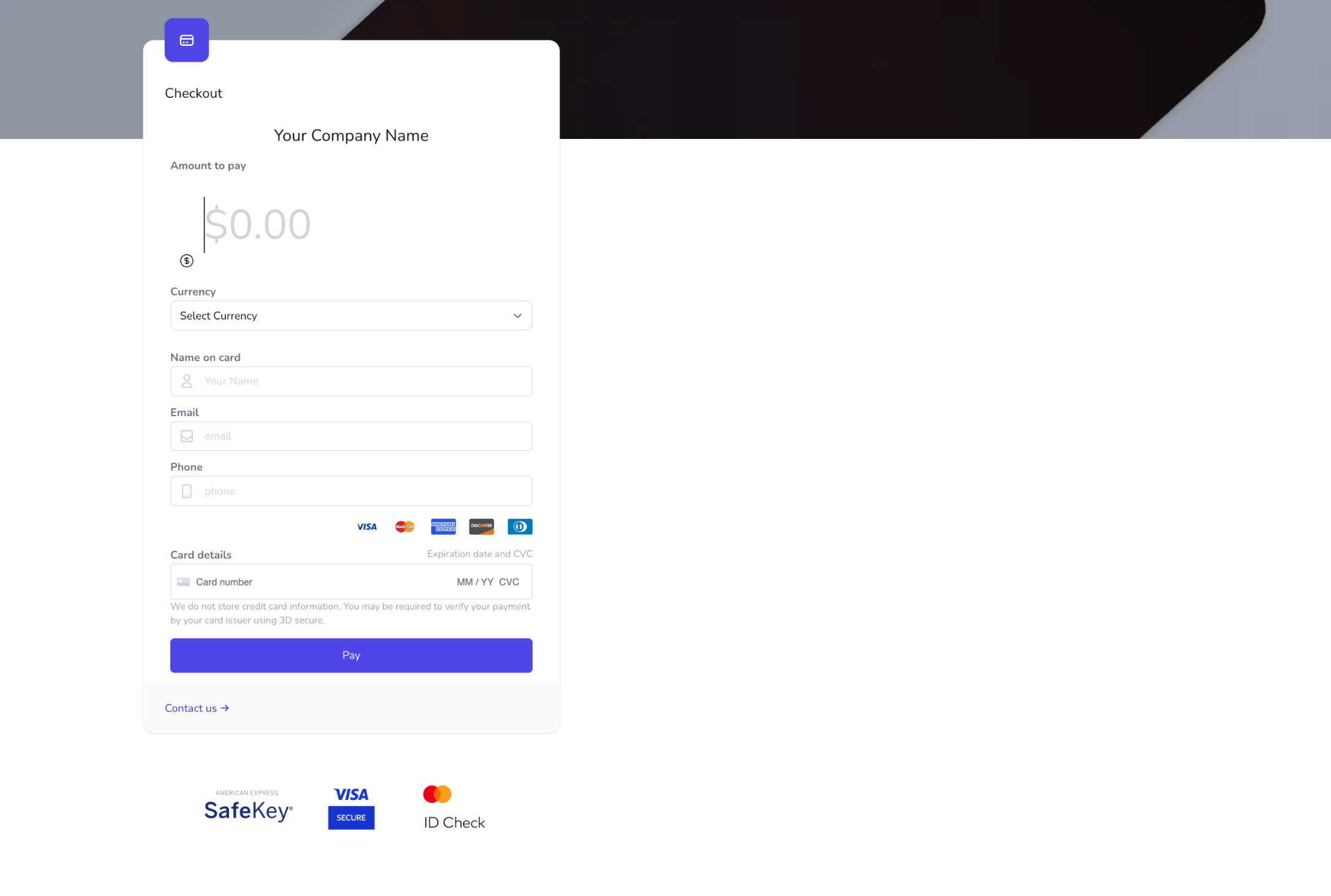

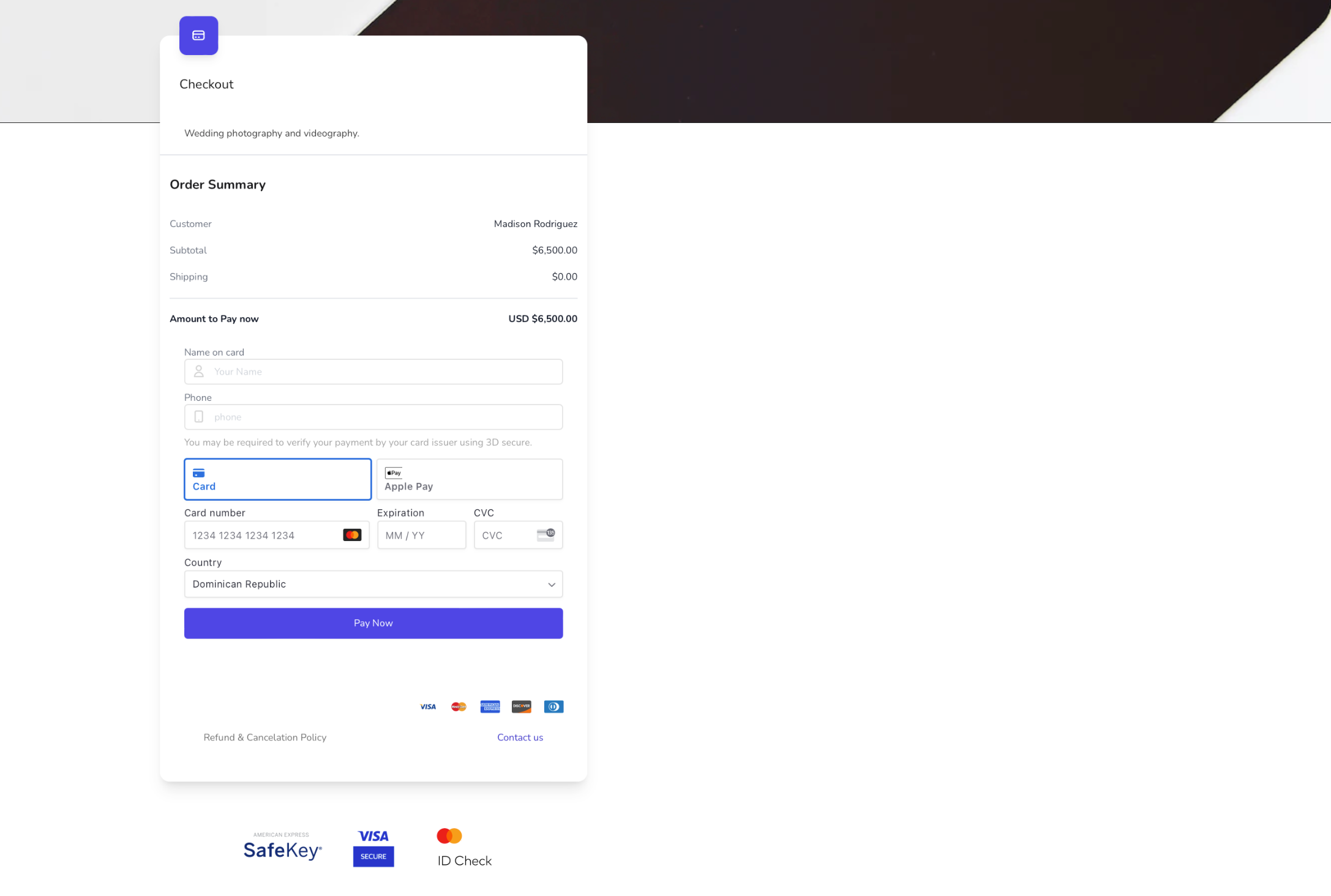

From simple checkout links to full e-commerce solutions, WhatsApp payments to comprehensive APIs - everything your business needs to accept payments and grow.

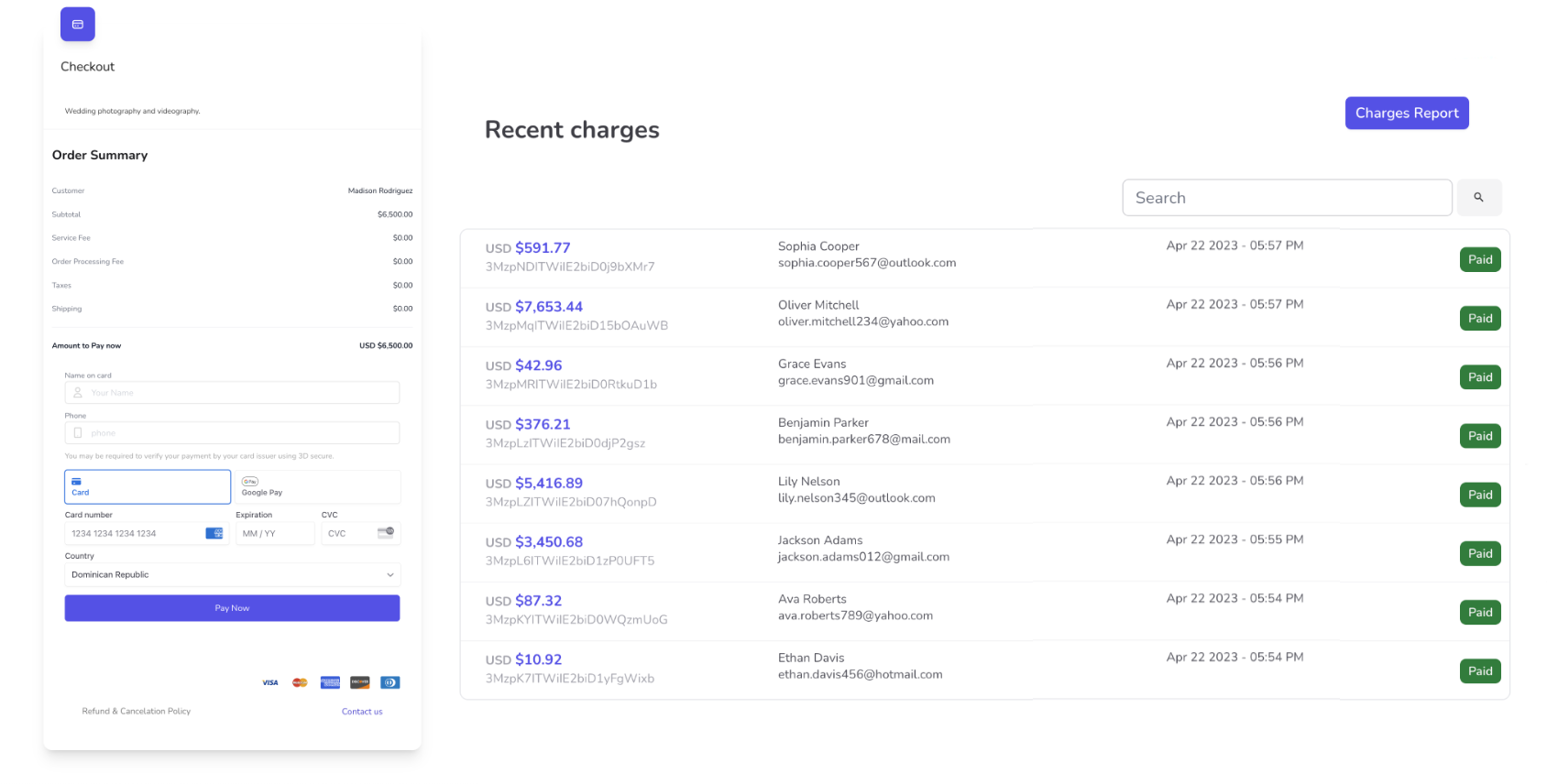

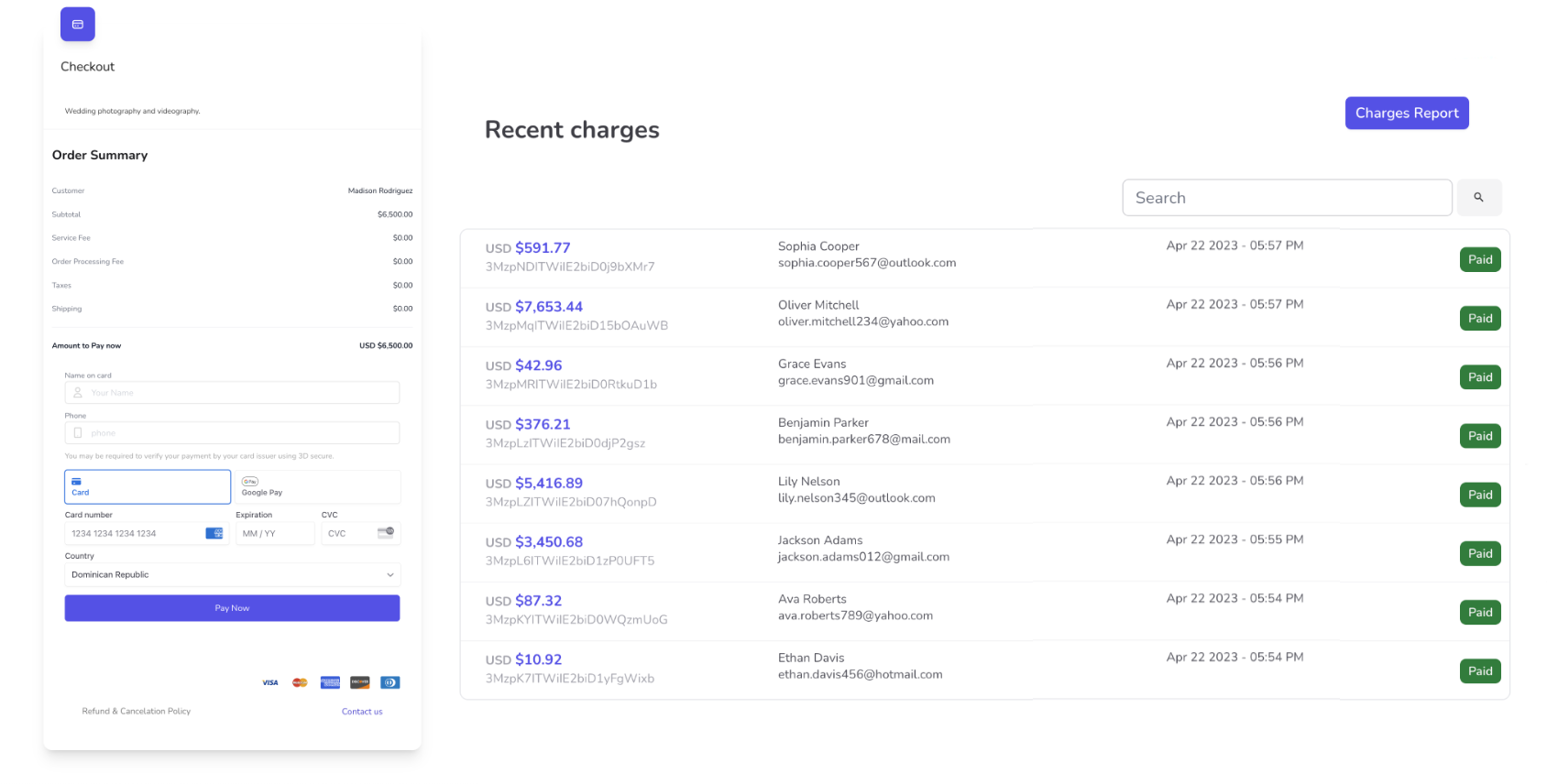

A fully optimized Checkout built for any device, hosted and designed for conversion and to reduce friction. An optimal experience across mobile, tablet, and desktop with a responsive User Interface.

Multi Company & Multi User.

Stop using the same account for different companies or shops. Have separate accounts for each project, website, or team. Each account has its own transaction data, reports, and checkout.

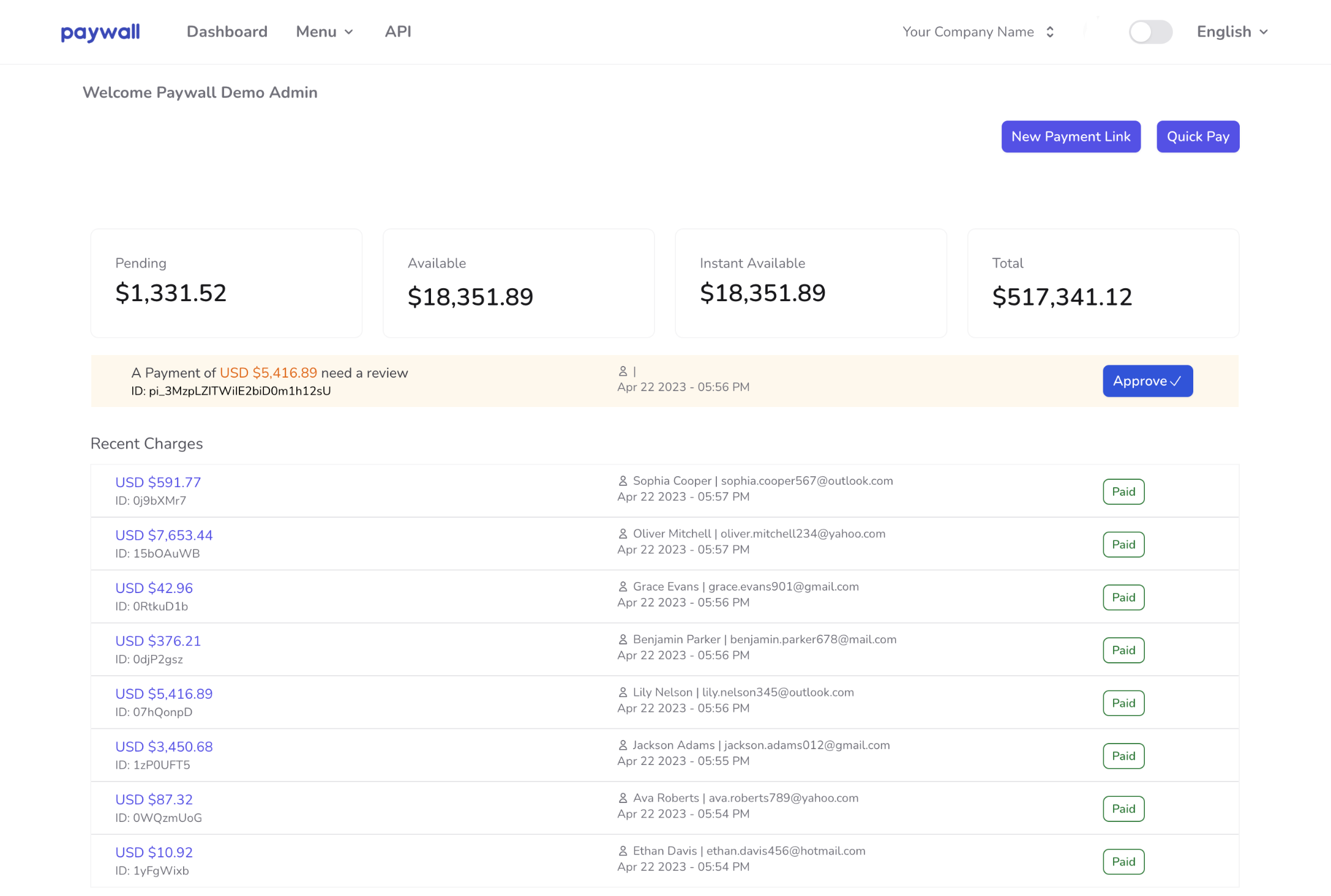

Real Time Reporting

Stay on top of things with always up-to-date reporting features.

View your payment transactions as they happen, and receive notifications in real-time. You can also view your profit and Balance in real-time.

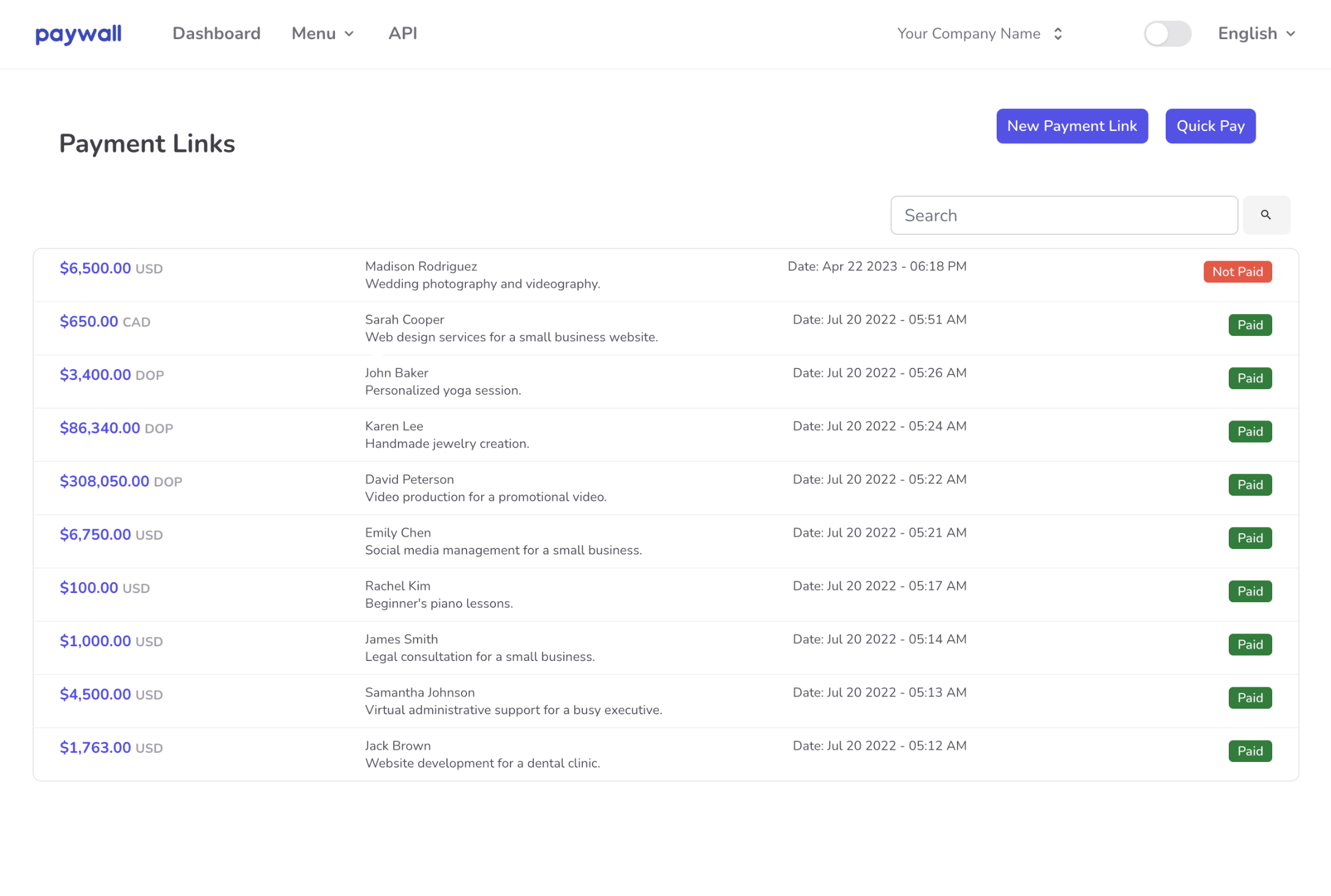

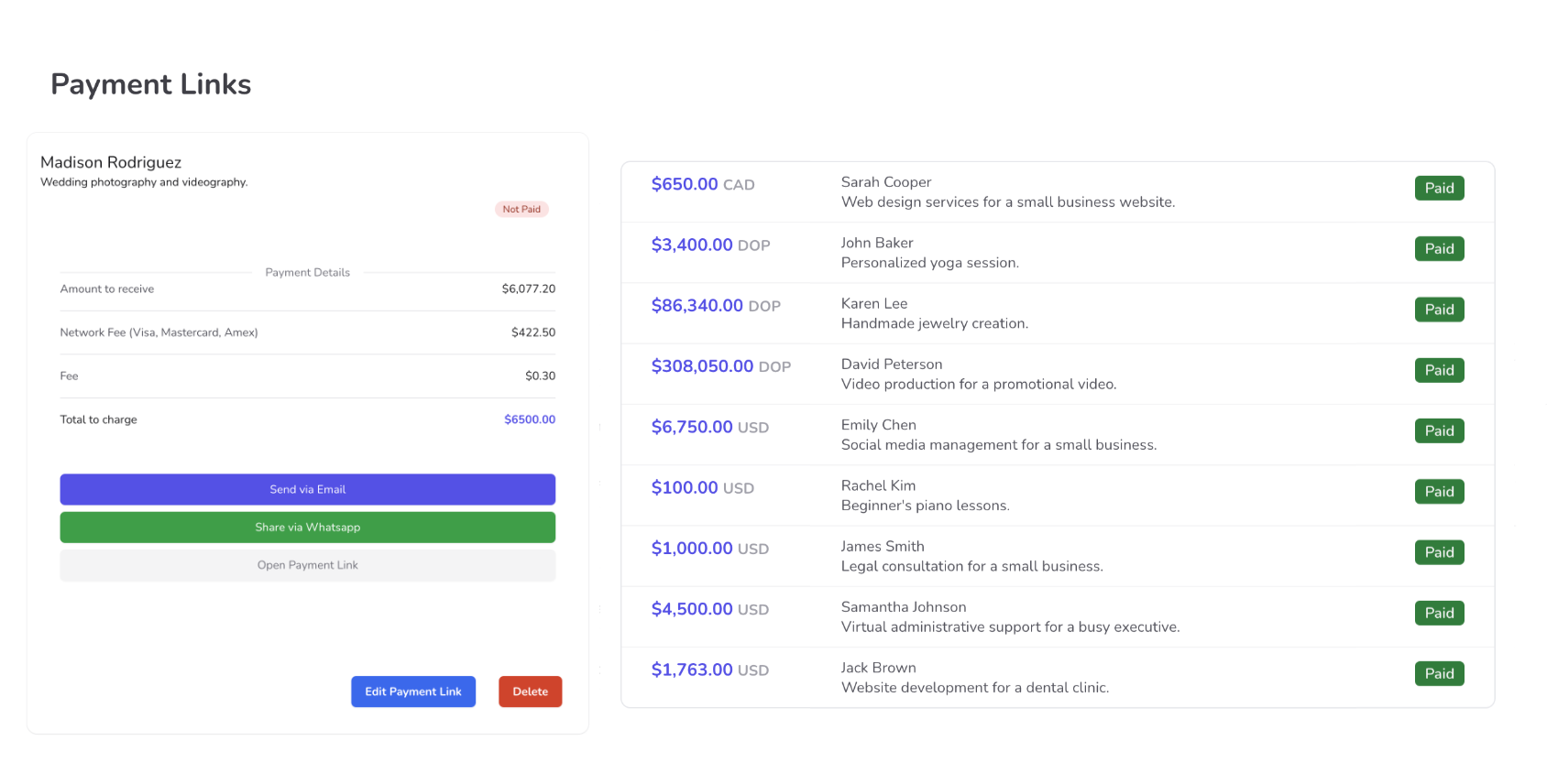

Payment links

Easily generate payment links for your customers to pay you directly.

Send Payment links to your customers via WhatsApp, or generate a QR code for them to scan and pay you directly.

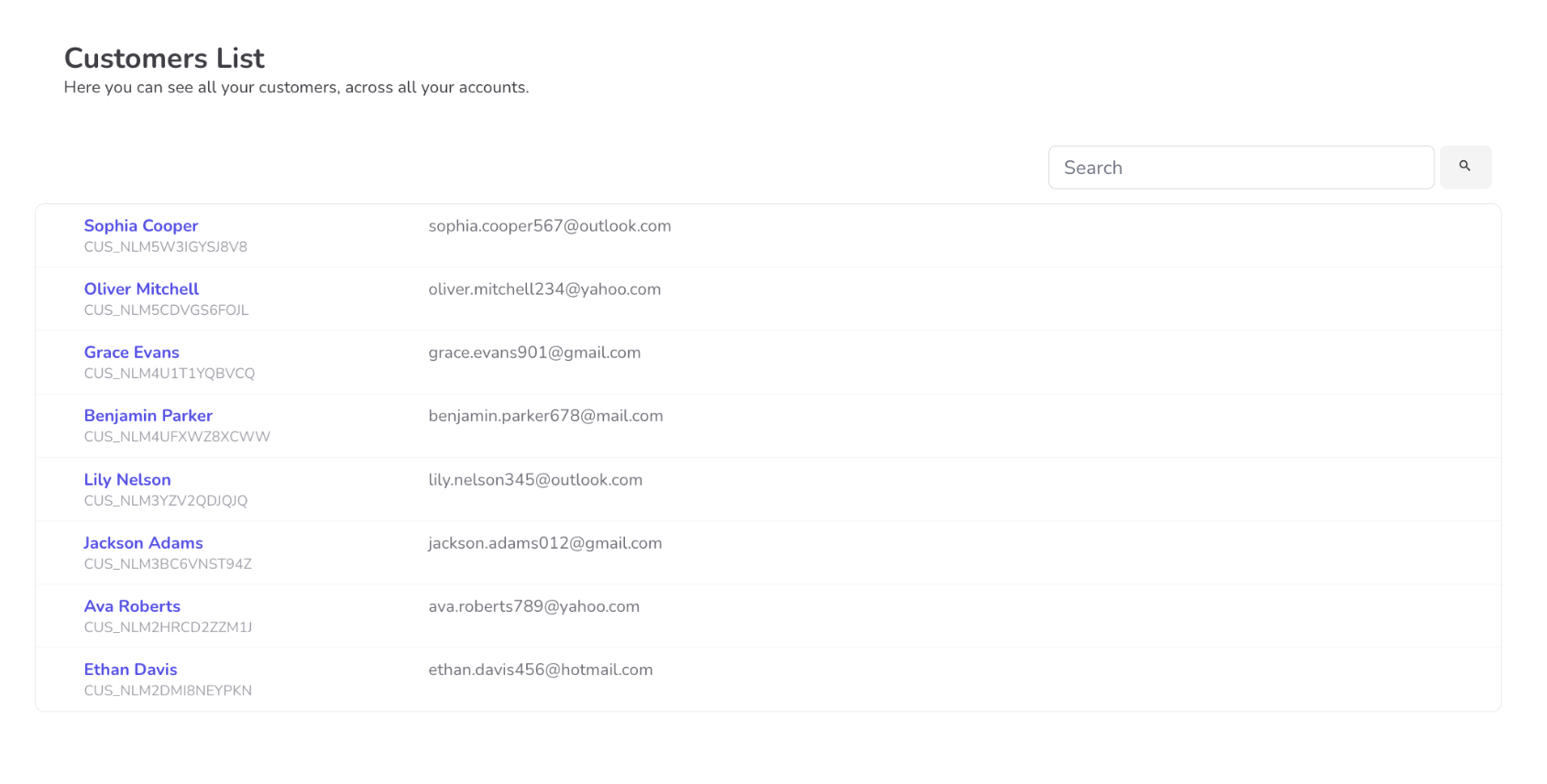

Customers

Organize all of your Customers, and Payment links in one place.

Access your Customers details and payment history in one place, integrate with your existing CRM system.

Stay on top of things with always up-to-date reporting features.

View your payment transactions as they happen, and receive notifications in real-time. You can also view your profit and Balance in real-time.

Easily generate payment links for your customers to pay you directly.

Send Payment links to your customers via WhatsApp, or generate a QR code for them to scan and pay you directly.

Organize all of your Customers, and Payment links in one place.

Access your Customers details and payment history in one place, integrate with your existing CRM system.

Power your business with smart integrations.

A connected solution for all your systems.

- Direct integration with your website

- Seamless connection to accounting software

- Automated order and fulfillment systems

- Compatibility with modern apps

- Support for legacy systems

- On-site relays for local systems

- Centralized data management

- Real-time updates across systems

- Scalable for growing businesses

Compatible with modern technologies and existing systems for a streamlined workflow.

Contact Our Integration TeamBring your processor, or use ours - you choose.

Flexible payment solutions that work with your existing setup or provide everything you need to get started.

Use your own payment processor, while we handle the rest

Bring your processor

0.5% + 0 cents

plus your processor fees

- No Monthly Fees

- Send Payment links

- Send Invoices

- WhatsApp Payments

- Donations Form

- Sell digital products

- Online shop

- POS Terminal

- Manage Customers

- API Integration

- Unlimited Transactions

- Currencies supported

- Payout managed by processor

All PayWall apps included - complete payment ecosystem

PayWall Complete

5.9% + 30 cents

plus 0.6 percent for 3D Secure

- All PayWall Apps Included

- Advanced Payment Links

- Professional Invoices

- WhatsApp Business Integration

- Multi-Currency Donations

- Digital Product Marketplace

- Full-Featured Online Shop

- Smart POS Terminal

- Advanced Customer Management

- Complete API Suite

- Unlimited Global Transactions

- 140+ Currencies supported

- Automated Payout Management

Online and WhatsApp checkout with API integration

PayWall Checkout

3.8% + 30 cents

plus 0.6 percent for 3D Secure

- Optimized Online Checkout

- WhatsApp Checkout

- Payment Link Generation

- Basic Invoicing

- Simple Donation Forms

- Digital Product Sales

- Essential Online Shop

- Mobile POS

- Customer Database

- Checkout API

- Unlimited US Transactions

- USD Primary Currency

- Standard Payout Schedule

Frequently asked questions

If you have any questions or concerns, please reach out to our support team for assistance.

Does PayWall handle VAT or taxes?

No, PayWall does not handle VAT or taxes at this time. You will need to manage them on your own.

Does PayWall have a monthly fee?

No, PayWall is free to use. You only pay a transaction fee when you receive a payment.

Can I have multiple PayWall accounts?

Yes, you can have multiple PayWall accounts. You can use different PayWall accounts for different purposes or businesses.

What is the maximum amount I can charge using PayWall?

PayWall does not impose any limits on the amounts you can charge. The maximum amount depends on the limits set by your own payment processor.

When will I receive funds in my bank account?

The timing of funds being deposited into your bank account depends entirely on your payment processor. PayWall does not hold or process funds.

What is the maximum amount I can charge per month?

PayWall does not impose any monthly limits. The maximum amount you can charge is determined by your payment processor's policies.

What type of payment methods can I accept?

PayWall supports integration with payment processors that accept Visa, MasterCard, American Express, Discover, Apple Pay, and Google Pay. The specific methods available depend on your payment processor.

Can I integrate PayWall with my accounting software?

If your accounting software has an API, PayWall can integrate with it. Please contact us to discuss the details and requirements.

I lost my password. How can I access my account?

You can reset your password by clicking on the “Forgot Password” link on the login page. Enter your email address, and we will send you an email with a link to reset your password.

Do I need a US bank account to use PayWall?

PayWall works with payment processors in 47 countries. You do not need a US bank account unless required by your payment processor. For the latest list of supported countries, please contact us.

Can PayWall work with multiple payment processors at the same time?

Yes, PayWall can integrate with multiple payment processors, allowing you to manage payments from different providers seamlessly.

Does PayWall support recurring payments or subscriptions?

PayWall integrates with payment processors that support recurring payments. The availability of this feature depends on your processor's capabilities.

Can I customize the checkout experience for my website or app?

Absolutely! PayWall allows you to fully customize the checkout process to match your brand, ensuring a seamless user experience.

Can PayWall integrate with my legacy systems?

Yes, PayWall can integrate with legacy systems using APIs or custom relays, ensuring compatibility across your existing workflows.

Does PayWall support order management systems?

PayWall can integrate with most order management systems, automating order creation and tracking after payment is completed.

How does PayWall handle accounting software integration?

PayWall can integrate with popular accounting tools like QuickBooks or Xero via their APIs, automatically syncing transaction data for accurate bookkeeping.

Is PayWall compatible with mobile apps?

Yes, PayWall can integrate seamlessly into mobile applications through APIs, enabling smooth transactions across platforms.

Does PayWall provide APIs for developers?

Yes, PayWall offers developer-friendly APIs for easy integration with websites, apps, and backend systems.

What security measures does PayWall offer?

PayWall integrates with payment processors that use industry-standard security protocols such as PCI DSS compliance, tokenization, and encryption.

What kind of support does PayWall offer?

Our team provides 24/7 support to assist with integrations, technical issues, and general questions. Contact us at hello@paywall.app.